The Future of CPA Licensure: Insights from an ASCPA Member Survey on the 150-Hour Requirement

January 05, 2024

In addressing the CPA pipeline challenge, we sought your input in September through a survey on the 150-hour education requirement for CPA licensure. Your valuable insights have enhanced our understanding of its impact on your organization, aiding the profession in exploring effective solutions.

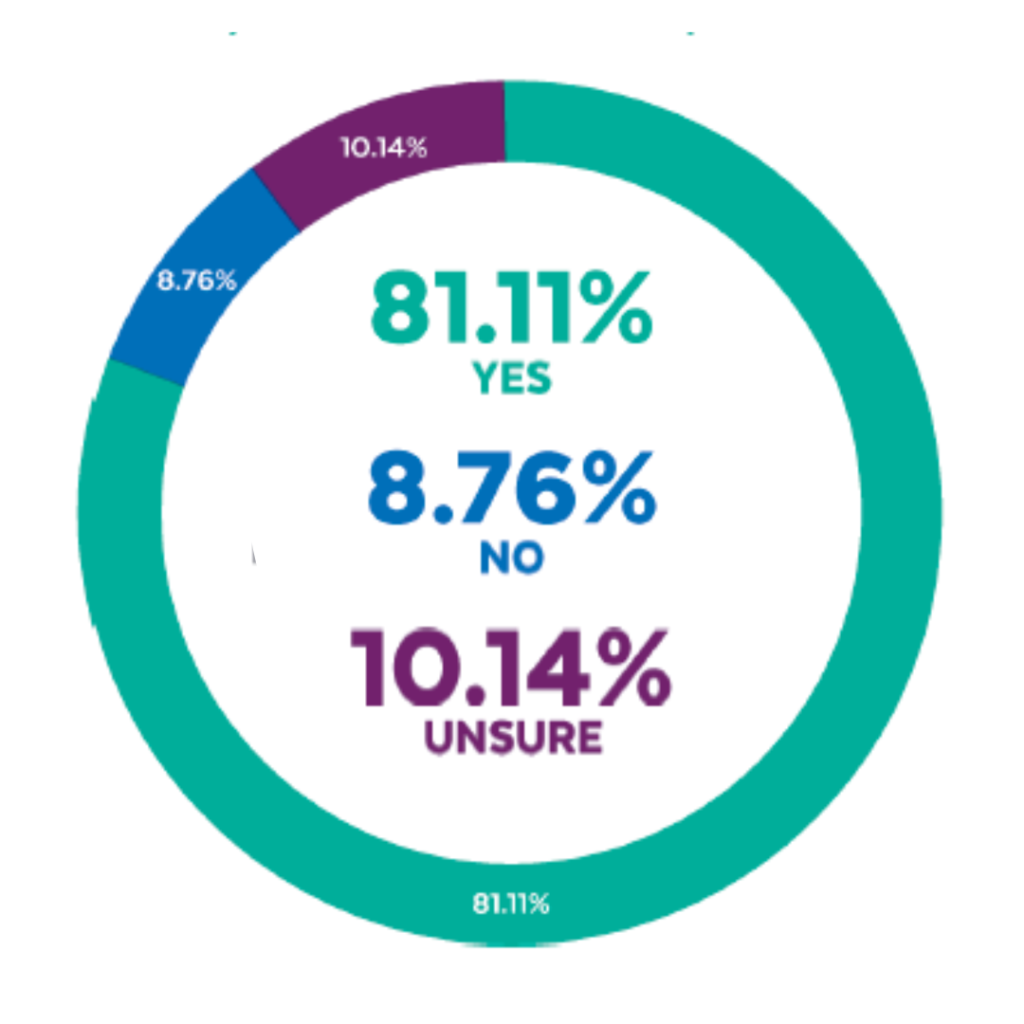

A significant finding from the survey is that 81% of members advocate for alternative routes to CPA licensure, beyond the 150-hour education requirement.

Do you believe it would be beneficial to the profession to provide alternative pathways to certification where 150 hours of college education is one option, but not the only option?

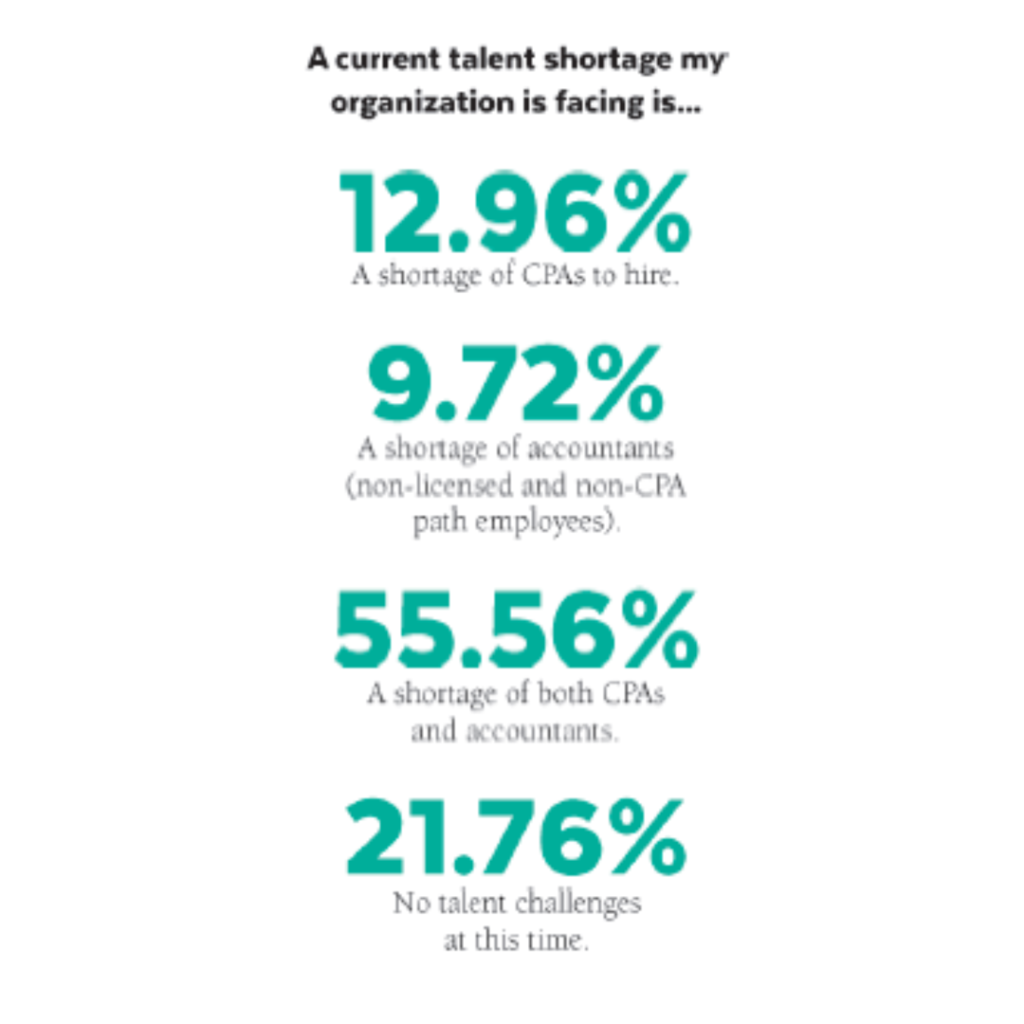

A noteworthy 56% of participants acknowledge a shortage of both CPAs and accountants, underscoring a widespread talent gap. Additionally, 13% specifically report a deficit in CPAs, 10% face shortages of accountants following non-licensed and non-CPA paths, while 21 % assert they experience no discernible talent challenges.

This collective data signals a substantial industry demand for skilled accounting professionals.

According to the survey, 51% of respondents perceive no disparity in the preparedness of their accounting staff, whether equipped with 150 or 120 hours of education. Conversely, 28% affirm a slight or notably elevated level of preparedness with 150 hours, and 20% express uncertainty regarding any discernible distinction.

Member Feedback

Members also shared their comments on the 150-hour requirement and ideas for alternative pathways.

Education vs. Experience: Several respondents propose replacing the 150-hour requirement with years of experience in the field, suggesting a more practical approach to certification.

Alternative Qualifiers: Suggestions include experience-based or additional testing, emphasizing critical thinking skills and expertise in specific areas like information technology or advisory services.

Work Experience Emphasis: A recurring theme is the importance of on-the-job experience, with suggestions for work experience requirements beyond mere time, akin to an apprenticeship.

CPA Exam Focus: Many argue that passing the CPA exam should be the primary criterion for certification, regardless of education hours, stressing its relevance as a measure of competence.

- Master's Degree Debate: A considerable number express dissatisfaction with the 150-hour rule, viewing it as an unnecessary financial burden, suggesting a disconnect between education and practical application.

- Specific Coursework: Many pointed out that the additional 30 hours of education may not be beneficial because these credit hours can cover any discipline, potentially lacking relevance to accounting or other courses essential for becoming a proficient CPA.

- Impact on Recruitment: The 150-hour requirement is viewed negatively in terms of recruitment, potentially deterring students and leading employers to hire without certification.

- Need for Non-CPA Professionals: A subset of respondents argues for the necessity of non-CPA accountants, emphasizing the demand for basic accounting services at a lower cost.

Conclusion

Members express a need for a more flexible and pragmatic approach to CPA certification, emphasizing experience, critical skills and the importance of passing the rigorous CPA exam. The accounting profession faces challenges in talent acquisition and retention, suggesting a need for adaptive strategies to address these concerns. To further this effort, we are working in tandem with the National Pipeline Advisory Group (NPAG) to identify and implement strategic next steps. The ASCPA will keep you updated on proposed alternative pathways and policies.