White-Collar Crime: What Every CPA Should Know

December 01, 2021

By David L. Cotton

Would you rather:

Find and report the white-collar crime as early as possible?

Or, explain why you failed to find and report the white-collar crime?

Could one of your clients be a white-collar criminal?

That’s undoubtedly a nightmare scenario for any CPA. Can’t happen to you, you say? That’s probably what the accountants for Barings Bank, WorldCom, Waste Management, Enron, Tyco, HealthSouth, Bernie Madoffand Baptist Foundation of Arizona – to name just a few – thought. Those CPAs did their due diligence before accepting these clients. (Well, not David Friehling, Bernie Madoff’s “auditor,” I guess. Friehling issued audit reports without doing any audit work. He belongs in a special category of accountants.)

CPAs need to understand that it can happen to them and that CPAs are, or should be, the first line of defense against white-collar crime. Why should CPAs be the first line of defense? Let’s look at a few definitions.

The term white-collar crime is now synonymous with the full range of frauds committed by business and government professionals. These crimes are characterized by deceit, concealment or violation of trust and are not dependent on the application or threat of physical force or violence. The motivation behind these crimes is financial – to obtain or avoid losing money, property or services or to secure a personal or business advantage. [FBI.Gov]

White-collar crimes are financially motivated crimes committed by individuals, businesses and government entities. The actual term “white collar crime” was coined by Edwin Sutherland, Professor of Sociology, 29th President American Sociological Society. Sutherland described such crimes as “a crime committed by a person of respectability and high social status in the course of his occupation.”

White-collar crimes cover a wide range of activities, but generally, the crimes are committed by people who are involved in otherwise lawful businesses. The perpetrators often hold respectable positions in their communities or businesses, until their illegal activities are discovered. [LegalDictionary.net]

So, white-collar crimes are committed by business and government officials, persons of respectability and high social status in the course of their occupations, people who are involved in otherwise lawful businesses, and people who hold respectable positions in their communities or businesses.

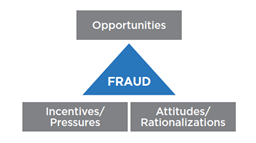

In other words, white-collar crimes are committed by people who employ CPAs. CPAs need to understand why their clients might commit white-collar crimes. The easiest explanation lies within the fraud triangle.[1]

Any of our clients might find themselves, through no fault of their own, suddenly facing unbearable financial pressure. They likely have a variety of possible rationalizations for crossing the ethical and legal line: “I’m just borrowing the money and will pay it back,” “everybody does it,” “I deserve it after how hard I’ve worked,” and so forth.

But, it’s that third leg, opportunities, that poses the greatest risk to CPAs. Our clients –members of management – are usually (some would argue, always) in positions where they can circumvent even the best systems of internal control.[2]

So, you and your client have had a long and mutually beneficial relationship. The client is a pillar of the community. There have been no audit findings in the past. The organization has a strong system of controls. The financial statements show no warning signs. You consider the client to be “low risk.”

Then, something happens, unbeknownst to you, that creates unbearable financial pressure for the client. Your guard is down. When the embezzlement, tax evasion, money laundering, insurance fraud or Ponzi scheme is eventually discovered, guess where many of the fingers will be pointing?

As the first line of defense, our job is to maintain the highest degree of professional skepticism at all times.

Attributes of professional skepticism include a questioning mind, … and a critical assessment of evidence. Professional skepticism includes being alert to, for example, evidence that contradicts other evidence obtained or information that brings into question the reliability of documents or responses to inquiries to be used as evidence. Further, it includes a mindset in which auditors assume that management is neither dishonest nor of unquestioned honesty. [General Accepted Government Auditing Standards, 3.110.]

No one wants to be in the position of needing to report actual or suspected white-collar crime committed by a client. But, as trusted business advisors and custodians of business records, we are often in the best position to see evidence of such crimes. Isn’t it better to be vigilant and find the fraud when it’s small? Charlotte Bell, an Association of Certified Fraud Examiners colleague of mine always says, “There are no small frauds, just frauds that haven’t matured yet.”

Be vigilant. Be professionally skeptical. And, to paraphrase Admiral Spock, “Live long, prevent and detect fraud, and prosper.”

- [1] The term “fraud triangle” was “a model developed by Dr. Donald Cressy, a criminologist whose research focused on embezzlers—people he called ‘trust violators.” [ACFE.com]

- [1] For an eye-opening discussion of this risk, see Management Override of Internal Control: The Achilles’ Heel of Fraud Prevention at https://www.cottoncpa.com/wp-content/uploads/2014/08/updated_achilles_heel_2016.pdf

Dave Cotton, CFE, CPA (licensed in VA), CGFM, is founder and chairman of Cotton & Company LLP, headquartered in Alexandria, Virginia. Dave was the recipient of the ACFE 2018 Certified Fraud Examiner of the Year Award (“presented to a CFE who has demonstrated outstanding achievement in the field of fraud examination … based on their contributions to the ACFE, to the profession, and to the community”). He speaks at the Governmental Accounting Conference on February 4, 2022.