Taxation of Canadians in the U.S.

December 01, 2023

by Dale A. Walters, CPA

It is estimated that over 1 million Canadians file tax returns in the U.S. and that another 1 million should be filing, but don’t. The main reason the Canadians that should be filing but don’t is that they do not fully understand the U.S. residency requirements and therefore the requirement to file U.S. tax returns.

Based on my review of hundreds of returns over the past 30 years– even of the Canadians that do file– most have serious mistakes on their returns.

I can’t blame the Canadians for the fact their U.S. tax returns are most likely being done incorrectly. Taxation in general is complex enough, add to that rules that are seldom used by most tax preparers, then toss in the Treaty that can modify the Canadian Income Tax Act and the U.S. Internal Revenue Code and you have a very complex set of rules.

The purpose of this article is to highlight just one subject Canadians living in the U.S. face: the taxation of Canadian Retirement Plans.

Registered Plans

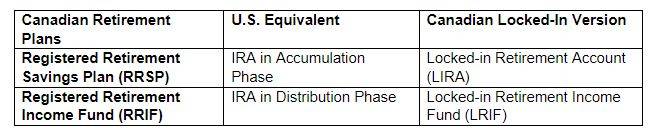

Just like the U.S., Canada has several types of retirement plans, but the most common types are Registered Plans such as the Registered Retirement Savings Plan (RRSP) and the Registered Retirement Income Fund (RRIF), both of which have locked-in versions. Think of Canadian Registered accounts like U.S. Qualified accounts. The other common retirement account is a Tax-Free Savings Plan (TFSA), which is like a Roth IRA.

While the RRSP and RRIF accounts have zero basis in Canada, they do have basis from a U.S. point of view. The amount of basis in the U.S. depends on whether thetaxpayer was a U.S. citizen or Green Card holder during the accumulation phase. If so, the basis is equal to the contributions that were not deductible on the U.S. return. Depending on when the contributions were made and the amount of the contributions, the deductible portion could be anywhere from 0% to 100%. In most cases, the Canadian will be neither a U.S. citizen nor a Green Card holder, and their initial basis will equal the fair market value of the account, less any unrealized gains, as of the day the person became a U.S. taxpayer.

If an RRSP is being deferred, the U.S.-Canada Tax Treaty, allows a U.S. taxpayer to also defer the account from U.S. tax. Typically, using while benefiting from the Treaty would require you disclose the fact that the Treaty is being used to alter the default handling of the income. This disclosure is done using IRS form 8833. While the Treaty and the Regulations specifically carves out Canadian RRSP and RRIF accounts, the accounts will have FBAR (FinCEN form 114) and FATCA (IRS form 8938) reporting requirements when the aggregate dollar amount of foreign accounts exceed the reporting limits.

While the regulations specifically mention the RRSP and RRIF by name, it is assumed that the IRS also meant that all Canadian Registered Retirement accounts are included. While I only mentioned two such accounts, at least another half-dozen accounts are considered Registered accounts and should be covered by the Treaty. Note that Canadian Registered accounts are not considered foreign trusts and that Personal Foreign Investment Company (PFIC) reporting is not required.

TFSA

A TFSA is like a Roth IRA, meaning that in Canada the money goes in after tax and comes out tax-free. Unlike Registered accounts, the TFSA is not covered by the Treaty. It is a matter of bad timing. The TFSA did not exist at the time of the latest amendment to the Treaty, so it was not considered and therefore not covered by the Treaty. That means that while the TFSA is tax-free in Canada, it is fully taxable in the U.S. Note that because the Roth IRA did exist at that time, it is covered by the Treaty and is tax-free in Canada.

Per Rev Proc 2020-17, the IRS states that a TFSA is a foreign trust and therefore IRS forms 3520 and 3520-A must be filed for each TFSA account. In addition, there isn’t a PFIC exception for foreign mutual funds and ETFs in a TFSA, as there is for the RRSP and RRIF. That means that a separate IRS form 8621 must be completed for each non-U.S. mutual fund or ETF in the account.

As a result, I strongly recommend that taxpayers living in the U.S. not use TFSAs and if they have them, they should be closed as soon as possible. Ideally, the TFSAs would be closed prior to becoming a U.S. taxpayer.