Legislative and Board of Accountancy Update - March 2024

March 25, 2024

This month’s update includes an overview on the legislative session so far, fiscal highlights and an update on the State Board of Accountancy meeting.

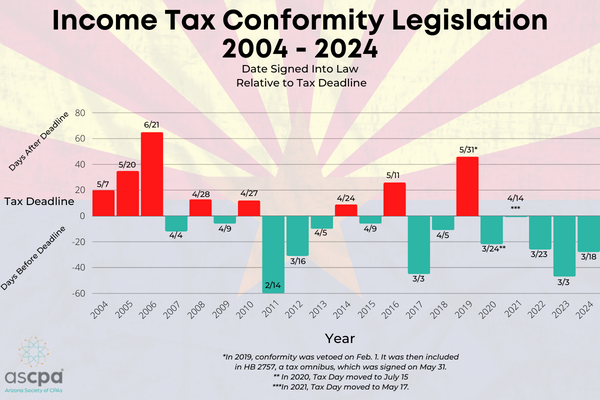

Advocacy Win: Income Tax Conformity Signed into Law

Just last week, Gov. Hobbs signed HB 2379 (internal revenue code; conformity) into law. The Governor’s signature follows swift action by the Legislature, which substituted SB 1057 for HB 2379 and passed unanimously on February 29.

We sincerely appreciate the quick action of the Legislature and Governor on this important annual process.

Arizona Legislature

March 26 marks the 79th day of the legislative session. To date, 1,629 bills and 130 resolutions and memorials have been introduced for a total of 1,759 pieces of legislation.

Lawmakers are passing bills at a very slow pace, partly due to the House's hiatus while 17 members traveled to Israel March 5-11. To date, just 18 bills have been sent to the Governor; 16 were signed and two were vetoed. March 22 was the last day for committees to hear bills from the opposite chamber, and increased floor activity is expected in the coming weeks.

Little progress has been made between Republican and Democratic leadership and the executive branch on the state budget. Nothing official has been released, but meetings between leaders are rumored to have begun.

JLBC Fiscal Highlights

The Joint Legislative Budget Committee (JLBC) released the Monthly Fiscal Highlights for February. In January 2024, General Fund revenue collections totaled $1.48 billion, which is 3.9% below January 2023. January revenues generated a modest forecast gain of $6 million above the Baseline budget forecast.

Additionally, sales taxes grew by 2.5% compared to January 2023, and individual income taxes were 0.6% greater than last year and $1.6 million above the Baseline forecast. Marijuana tax revenue increased by 7.8% compared to last year and is the second highest level of collections on record.

View the full report, here.

Attorney General Mayes Sues IRS

In late February, Attorney General Kris Mayes announced the State of Arizona has sued the IRS to prevent it from taxing last year’s state-issued Families Tax Rebate. In May 2023, Arizona enacted the tax rebate to provide financial relief to eligible taxpayers. Based on previous IRS guidance, the State understood that such rebates would not be considered taxable income. The IRS deviated from previous rulings and opted to tax Arizona’s Families Tax Rebate. The lawsuit argues treating these rebates as taxable is unlawful and contrary to the IRS’s treatment of similar rulings in other states.

The lawsuit specifically alleges:

- Unlawful Taxation: The IRS's decision to tax the rebates lacks legal basis and contradicts prior IRS guidance and precedents.

- Arbitrary and Discriminatory Treatment: The decision by the IRS is arbitrary, capricious and unfairly targets Arizona taxpayers.

- An Economic Impact and Violation of Taxpayers' Rights: Taxing these rebates affects not only the individual taxpayers but also the broader economic well-being of Arizona, reducing the disposable income of taxpayers and state sales tax revenue.

Arizona State Board of Accountancy

At this month’s meeting, Board staff provided an update on NASBA’s communication and outreach services and how the Arizona Board may be able to take advantage of these services. There was also a brief update on the Professional Licensure Task Force’s Exposure Concept which would include a Structured Professional Program.

Board staff provided an update on the expedited rule change request initially submitted to the Governor’s Office in late 2023. Requested changes included:

- items related to the introduction of the new exam

- a credit relief initiative to increase the timeframe from 18-30 months

- an extended registration fee reduction

- corrected legal citations

- and updated incorporations by reference.

Board staff heard back from the Governor’s Office that the requested changes were approved, except for the extension of the reduced registration fee.

Articles impacted by the requested changes to the Arizona Administrative Code (ACC) include:

- R4-1-229 (Conditioned Credit)

- R4-1-341 (CPA Certificates; Firm Registration; Reinstatement; Reactivation)

- R4-1-345 (Registration; Fees)

- R4-1-454 (Peer Review)

- R4-1-455 (Professional Conduct and Standards)

Professional Licensure Task Force Releases Exposure Concept

The National Association of State Boards of Accountancy (NASBA) Professional Licensure Task Force issued an exposure concept on the equivalent licensure model. The proposed program would include education and documented experience to provide an alternative pathway to licensure without completing the 150-hour education requirement. More information on the concept can be found here.

NASBA is seeking feedback on the concept by emailing PLTF@nasba.org or via the online response form by March 31, 2024.

For additional information on our advocacy activities, contact Emily Webb.