Tassel to Talent Pipeline: The State of Accounting Education in Arizona

May 01, 2023

by Haley MacDonell

Few explanations are needed for the term “talent pipeline.” If you’re in the accounting profession, you are already challenged when hiring staff, expanding your client offerings or even maintaining your current business due to a shortage of qualified talent.

According to the Wall Street Journal, more than 300,000 U.S. accountants and auditors left their jobs from 2020 to 2022.

Paired with the warning signs of declining college enrollment and dropping interest in pursuing the profession in general, the industry is investing more time and resources to stop the bleed.

Today’s students are making decisions right now that affect the accounting pipeline five years down the line, and educators are on the front lines of the dilemma.

Grounding Concepts at the Public Four-Year University

Tall sky cranes loom over Mill Avenue and the Tempe waterfront as apartment complexes and offices appear. Arizona State University’s Tempe campus is changing too, as old academic buildings are renovated and new ones appear.

The campus is always bustling. On Thursday evenings, over 175 students pile into a lecture hall for ACC 231: Uses of Accounting Information. For more than an hour, Professor Scott Emett lectures in front of the big, illuminated screen. Every few slides, students shuffle through their papers and answer multiple choice questions that have been pushed to their phones and laptops. The responses tally up in real time, and Emett can quickly spot which topics are most challenging to the students.

“I want you all to assume that you are the executive team for Samsung,” Emett said as he clicked to the next slide. There’s a news clip ready to play about the 2016 incident when Samsung phone batteries caught on fire. “Watch this video clip and imagine what type of liabilities might arise for Samsung as a result of this happening.”

Few of the students are accounting majors, and few want to be when they first start the semester, but this course is mandatory for several degrees and certificates in the W.P. Carey School of Business. With Emett at the helm, the course has radically changed over the last two years. Using grounded examples, like the Samsung incident, puts accounting concepts into the context of business.

“At its core, accounting is about producing useful information,” explained Emett. “Almost any major or career path in business is going to need a fundamental understanding of accounting to succeed.”

When he was a student, Emett hadn’t been interested in accounting either, but an introductory accounting class changed that.

“The professors totally shattered misconceptions I had about accounting and what accountants do,” Emett said. “They were witty, engaging and effective instructors. More than anything, they taught me the power of accounting in producing useful information, and business is all about making good decisions with good information.”

While ASU has not seen the substantial declines in college enrollment experienced by smaller institutions, the accounting department is aware of the need for a bigger pipeline of talent flowing into the profession. Four years into teaching at ASU, Emett was presented with the opportunity to bring more relevancy and excitement to these mandatory accounting courses. By doing so, he would teach over 800 students each semester and create updated curriculum and resources.

“I jumped at the opportunity because I am passionate about showing students the power of accounting,” Emett said. “We’ve got a captive audience to do that in these mandatory classes, even though it’s a lot of work and a lot of students.”

Emett wanted to replicate the experience that showed him what an accounting degree could do. There were three pillars guiding the course changes:

1. Focus on Decision-Making. While the fundamentals like debits and credits are still essential, the new curriculum grounds concepts in real-world applications. What information is needed to make decisions? How is this relevant and necessary to a career in business?

2. Highlight Career Possibilities in Accounting. Emett is helping students see how accounting can launch a variety of rewarding career paths through a series of videos interviewing ASU alumni who are using their accounting degree in unique career paths, like forensic accounting for the FBI and CFO of the Arizona Diamondbacks.

3. Embed Data and Technology. Accounting and auditing is harnessing more technology than ever before, and that will continue as artificial intelligence and automation improve.

There are myriad reasons being explored for why the accounting talent pipeline is drying up: accelerated retirement of the Baby Boomers, shifting expectations in work culture and salary, and the industry’s perception are just a few. Postsecondary education, and the people who could study accounting, have also been impacted by rising education costs, digital culture whiplash and a global pandemic that shuttered schools when today’s graduating seniors were just college freshmen.

For Aseem Chandi, an Arizona State University student graduating this month, COVID-19 moved all his classes and club events online during his second semester. It hampered his ability to connect with peers and find the right internship.

Then, he joined Beta Alpha Psi, an honor organization for financial information students and professionals that successfully transitioned to online events.

“All the webinars, seminars and presentations, they helped me feel more confident,” he said. He went on to join the board and become the organization’s treasurer. “Accountants are very high in demand right now. It's a very low risk, high reward profession. I found from speaking to people in the industry that in accounting, if you're willing to put in the work, then there is a clear path for you up to the top.”

Chandi remembered working with a small student cohort on a months-long technology project, and they presented resulted to staff. This kind of project-based learning on the job has been essential to understanding how the skills from the classroom fit into his future career.

“Students may not know a whole lot about real-world accounting when they graduate, but the experiences we got in school set us up to learn well quickly,” Chandi said. “When I entered my first internships, I felt kind of lost. I thought I needed to know everything on day one, and if I didn’t, I would be behind. But, that wasn’t true. Everyone was willing to help me learn.”

What You Can Do To Help

Together, we can change how the CPA profession is viewed. Share how being a CPA has created opportunities for you to thrive professionally and personally. Learn how you can be a part of the ASCPA’s Member Monday series on LinkedIn and Facebook.

The ASCPA has joined other state societies in supporting the Center for Audit Quality’s Accounting+ initiative, which uses social media to engage historically underrepresented Black and Hispanic communities to show them opportunities in the accounting profession.

Targeting the CPA at the Private Four-Year University

Driving 25 minutes west, it’s easy to spot Grand Canyon University from the I-17. In 2021, the private Christian university broke their record for total campus-based enrollment as they welcomed 23,500 students in the fall.

GCU’s accounting department split the accounting degree into two tracks: one designed for general accounting and another for public accounting, with an emphasis on preparing students to pass the CPA exam.

Kelly Damron is an associate professor of accounting who has been teaching at GCU for 10 years.

According to Damron, around 85% of her intermediate students in the public accounting track plan to sit for the exam. Though the split between tracks is close to even, Damron expects the numbers to shift as students learn more about their options.

“The goal of splitting the program was to improve the quality of our CPA candidates,” Damron said. “The students in our general accounting track are bettered suited for jobs that don’t require a CPA certification.”

Like ASU, GCU offers a wealth of resources to students, such as tutoring, company meet-and-greet events and specialty learning platforms. Damron adds presentations, templates, job offers and reviewed coursework solutions to her website to make it a hub for enrichment.

Still, some of the professional acumen comes only from experience. Damron recalled a conversation with a student who missed an internship application deadline.

“I don’t think she realized how important some of those deadlines are,” Damron remembered. “The lack of knowledge of the accounting profession is one of the biggest challenges we have with our students.”

In the fall, GCU hosts its second annual accounting orientation, now mandatory for students to inform them on the industry and how to best prepare for their career.

“Accounting is one of the most difficult business majors around,” Damron admitted. “It is sometimes really hard to encourage students to actually go to events like Meet the Firms because they're afraid to go. They’re likely to be introverts. They might lack those social skills. Going to an event where they have to put themselves out there is really hard for them.”

Accessibility and Exploration at Community Colleges

South Mountain Community College sits at the base of the mountain it’s named after in a part of southern Phoenix that is quickly developing. Likewise, SMCC is a mix of old and new buildings, with a public library nestled in the corner of campus and surrounded on all sides by large parking lots.

Of the approximately 5,000 students enrolled at SMCC, nearly 70% are first-generation college students and 80% identify as a minority. Few students have ever heard of the CPA designation until they see it at the end of Brian Smith’s name when they take an introductory accounting course.

“These students are all juggling schoolwork and other responsibilities at home,” Smith explained. “A lot of my students are under a lot of stress. They’re in school because they want to pull themselves out of the cycle. They want to better themselves and better the situation of their families.”

Postsecondary education poses an extra challenge for first-generation students. On top of a lack of financial resources, they may feel that they don’t belong. They might not have a family member or friend to help them navigate selecting courses, finding deals on textbooks or answering questions on financial aid, or what resources are available.

On a misty Tuesday, classes are back in session after spring break. Smith’s students, numbering about 20, sit in desks in groups of four. He opens class by reminding students to submit any late work for partial credit before the window closes after the midterm on Thursday.

“Are you sharing a study guide?” One student asked.

“Yes, I’ll be posting it right after today’s class,” Smith replied. “If I don’t by DECA today, send me an email.”

Students share their vacation details, like visits to Colorado, California and Lake Havasu. Many of these students chose business majors to explore different career opportunities.

“I tell them all the time, you can be a manager with an accounting degree,” Smith said, “but you can’t be an accountant with a management degree. Take the path that opens the doors.”

Yesenia Escareno is a first-generation student who attended South Mountain Community College on a full-tuition scholarship. She was one of many business majors still exploring career options when she took Smith’s accounting course during her first semester.

For Escareno, learning the concepts came naturally to her, and Smith encouraged her to pursue accounting.

“He was kind of my mentor the whole time,” she said. “After my first semester, I decided that I was going to focus on accounting.”

She graduated with her associate degree and transferred to Arizona State University. Escareno graduates this month with her bachelor’s.

“I wish I had known to start the transfer process a lot earlier,” she said. She had missed deadlines for scholarships and early enrollment that could have created a more concise class schedule. That had passed before she even knew she wanted to transfer. “It was a big change going from community college to the university. Sometimes, I felt like I was behind. The classes were bigger, and it was a bit harder to get in touch with professors one-on-one.”

As she began at ASU, Smith referred her to an internship with Tanya Luken CPA. It gave her a first professional experience working with clients on bookkeeping services and everyday accounting needs. It was also remote, making it easier to juggle courses and a job.

“Going into the industry, I felt really nervous,” she said. “These aren’t like the problems you do in class. It’s real-world accounting.”

What You Can Do To Help

As the cost to obtain a four-year degree increase, financial support can make a difference in the lives of accounting students. Over almost 30 years, the Arizona CPA Foundation for Education & Innovation has been rewarding exceptional applicants with scholarships at private and public Arizona universities.

Professors and educators, regardless of the institution, wear many hats to help students succeed. They keep current on the industry, teach new concepts and catch students up who may have missed key soft skills, like following directions for assignments or effectively taking notes. According to Smith, 90% of more of his students don’t know Excel or only know the most basic applications. It’s a skill he wishes more students were familiar with.

On campus clubs like DECA, a not-for-profit career and technical student organization, can play a big role in student engagement and developing professional and leadership skills. DECA is funded by the Department of Education to prepare the emerging leader and entrepreneur within high school and college students. At conferences, students are judged by working professionals in 30 competitive events. They’re given a problem to solve by researching, critically thinking and role playing through professional scenarios.

Smith has been SMCC’s DECA advisor for four years. At the last conference, two of his students placed in the top three in the accounting competition.

“We teach them soft skills and how to interview,” Smith said. “We do community service. When they’re in the workforce or seeking employment, we want to set them up to be successful. It’s a really good place to test drive your major and what you want to do. If you don’t like it, you can try something else.”

What You Can Do to Help

The ASCPA is launching new programs to support future CPAs, and we need your help to make it happen! We have a wide range of volunteer opportunities, with minimal time commitments.

Click here to learn more about volunteer student engagement opportunities.

Ready to talk to students now? Fill out our interest form.

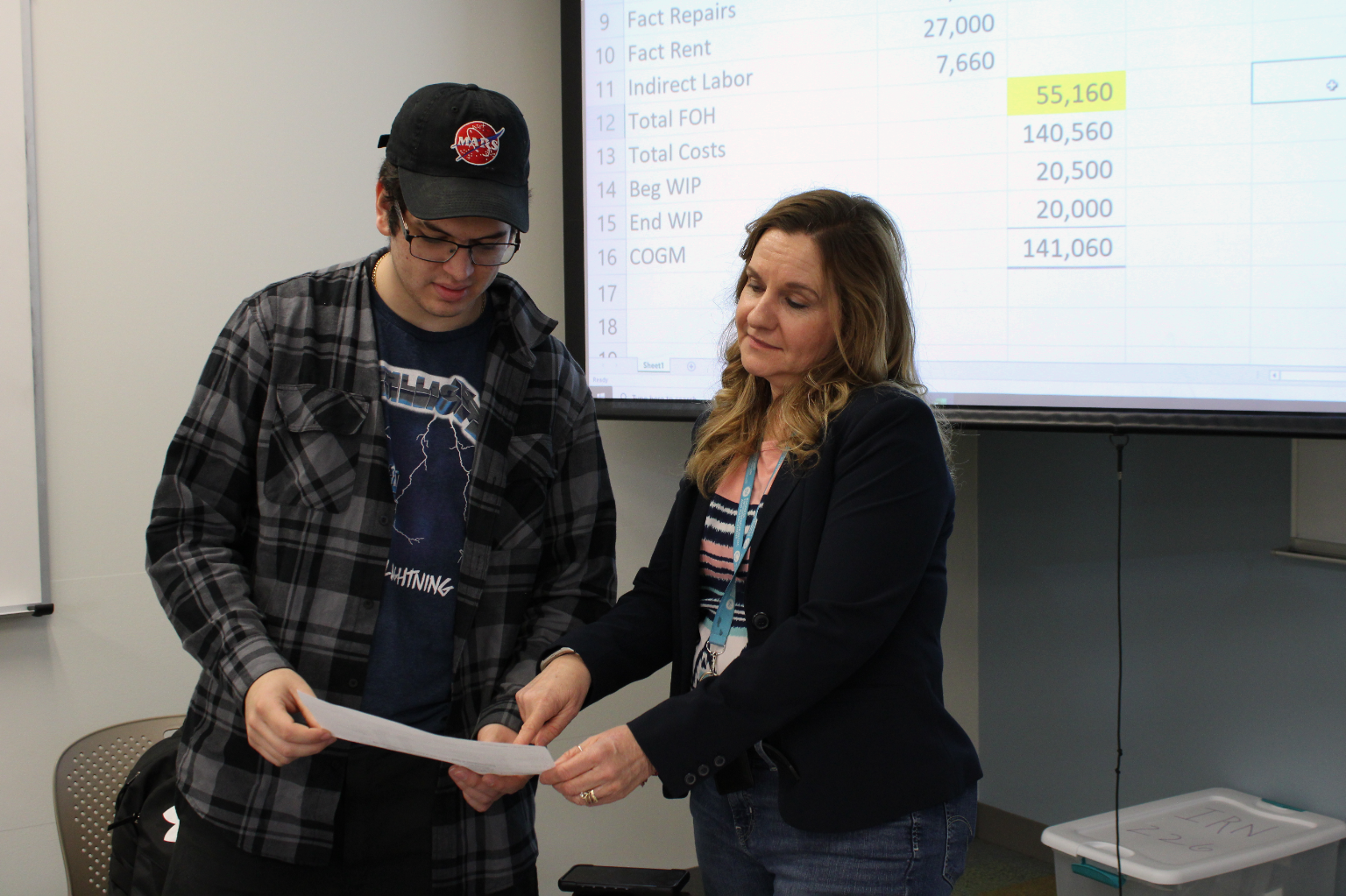

Barbara Gonzalez, division chair of business and computing studies with Maricopa Community Colleges, teaches at Chandler-Gilbert Community College, a 30-year old campus that has expanded and renovated over the years. It’s a mix of old and new, just like SMCC. In her class of about 30 students, she is often on her feet: writing notes on the white board, circulating as students work through examples and back to the computer to type formulas in Excel.

Calculators click furiously as students work through the sample problems, aided by an embedded tutor that provides extra help during class. Gonzalez calls students out by name, and they walk to the board to show their work for today’s lesson involving reporting costs and income statements.

She’s passionate about helping students succeed, and maybe persuade them to try accounting along the way. With some students, it just clicks.

“They ask different questions, more probing questions,” she said. “I just sent a resume to a CPA firm looking for an intern. I think he’ll get it because he’s also a veteran. He’s hard-working. He’s a great student and good writer too, which can be hard to find.”

As students start looking for internships and work experience, she’s seen that some organizations already have a reputation. She remembered a student that wasn’t interested in applying for a well-paid position because of the company’s values and culture.

“Most of them want to be with a company that they feel is contributing to society,” Gonzalez explained. “They want to make sure it's a reputable company; that there is work-life balance.”

According to a 2021 Gallup poll, young Millennials and Gen Z want their organization to care about the employees’ wellbeing above all else. These values are exemplified in how organizations pay their workers, respect their time off and invest in their employees through wellness programs and professional upskilling.

“I think that could be some of our issues in accounting,” she said. “My generation, we worked 60 hours a week and it was high stress. We used to say that our working papers would come back bloody, because there was so much red over it. That can be high stress for these students, and there are many students with anxiety.”

There is a lot of untapped potential at Arizona community colleges. While traditionally these schools only offer two-year degrees, Maricopa Community College will start offering bachelor’s degrees in the fall. The scope is limited to only seven majors, in areas like education and information technology, but there is hope to include accounting one day.

You can be a part of the solution. Click here to learn about student engagement initiatives coming this year.