The Path to CPA Licensure in Arizona: Current Requirements and Proposed Changes

May 06, 2025

By Emily Webb

Becoming a Certified Public Accountant (CPA) in Arizona requires meeting specific educational, exam, experience and ethics requirements established by the Arizona State Board of Accountancy. As of 2025, these requirements follow a well-defined pathway, but proposed changes are reshaping how aspiring CPAs can obtain licensure. This shift aims to modernize the process and make it more flexible, addressing issues such as the rising cost of education, changing workforce expectations and the need for greater talent in the accounting profession.

Current Pathway to CPA Licensure in Arizona

The first step toward becoming a CPA in Arizona is meeting the educational requirements through the completion of 150 semester hours from an accredited institution. While a bachelor’s degree is required, candidates have two options to fulfill the remaining credit hour requirement. One way is to obtain a master’s degree and another is to take 30 additional credit hours without obtaining the master’s degree. However, 36 of the semester hours must be in advanced accounting courses to ensure candidates acquire the necessary expertise in the field. The education requirement is designed to provide a broad base of knowledge in accounting, business and other related fields.

Once the educational requirements are met, candidates must pass the Uniform CPA Exam, a comprehensive test covering four sections. You must pass the three required core sections:

• Audit (AUD)

• Financial Accounting and Reporting (FAR)

• Regulations (REG)

You must also pass one discipline section of your choice:

• Business Analysis and Reporting (BAR)

• Tax Compliance and Planning (TCP)

• Information Systems and Controls (ISC)

A passing score of 75 in each section is required.

Along with passing the exam, candidates must also accumulate 2,000 hours of relevant accounting work experience under the supervision of a licensed CPA. This practical experience ensures that candidates can apply their academic knowledge in real-world scenarios.

Additionally, Arizona requires candidates to pass the American Institute of Certified Public Accountants (AICPA) Professional Ethics for CPAs Exam. Candidates must score a minimum of 90%. This final step ensures that prospective CPAs understand the ethical responsibilities associated with their role, which is crucial for maintaining public trust in the profession.

Proposed Changes to the CPA Licensure Pathway

The AICPA and the National Association of State Boards of Accountancy (NASBA) have proposed significant changes to the Uniform Accountancy Act (UAA), which guides the CPA licensure process.

The new pathway does not replace the existing two options but instead complements them. It would allow candidates to become CPAs with a bachelor’s degree in accounting, two years of professional experience and a passing score on the CPA exam. By focusing on work experience rather than additional coursework, the proposal seeks to make the licensure process more accessible and better aligned with the practical needs of the profession.

In addition to the new licensure pathway, the proposal includes a shift to an “individual-based” mobility model. Under this model, CPAs would be able to practice in other states with just one license, making it easier for professionals to work across state lines without the need to obtain multiple licenses. Furthermore, the proposal introduces “safe-harbor” language to protect the practice privileges of current CPAs who meet existing licensure requirements, ensuring that their ability to practice is not compromised by these changes.

Why Are These Changes Being Proposed?

The proposed changes are driven by several key factors, including the evolving landscape of education, shifting workforce expectations and the ongoing talent shortage in the accounting profession.

The rising costs of higher education have made the traditional 150-credit-hour requirement a financial burden for many students. With tuition costs increasing, many prospective candidates find it difficult to justify the time and expense involved in meeting this requirement. The new pathway is intended to reduce this barrier, making it more feasible for individuals to enter the profession without additional financial strain.

Moreover, younger generations of professionals increasingly value flexibility, work-life balance and practical experience over traditional academic credentials. Many of these candidates are attracted to careers that allow them to gain real-world experience while maintaining a better work-life balance. The new licensure pathway reflects this shift by focusing more on practical skills gained in the workplace rather than classroom time.

This change is also a response to the evolving nature of accounting work, which increasingly requires proficiency in areas such as data analytics, IT and advisory services. The modern CPA must be adaptable, and the new pathway aims to ensure that future CPAs are equipped with the relevant skills needed for today’s accounting challenges.

The accounting profession also faces significant challenges related to talent shortages. With many graduates choosing careers in other fields such as finance, consulting or technology, accounting firms are struggling to attract and retain qualified professionals. These proposed changes are a proactive effort to address the challenges faced by aspiring CPAs and the accounting profession at large.

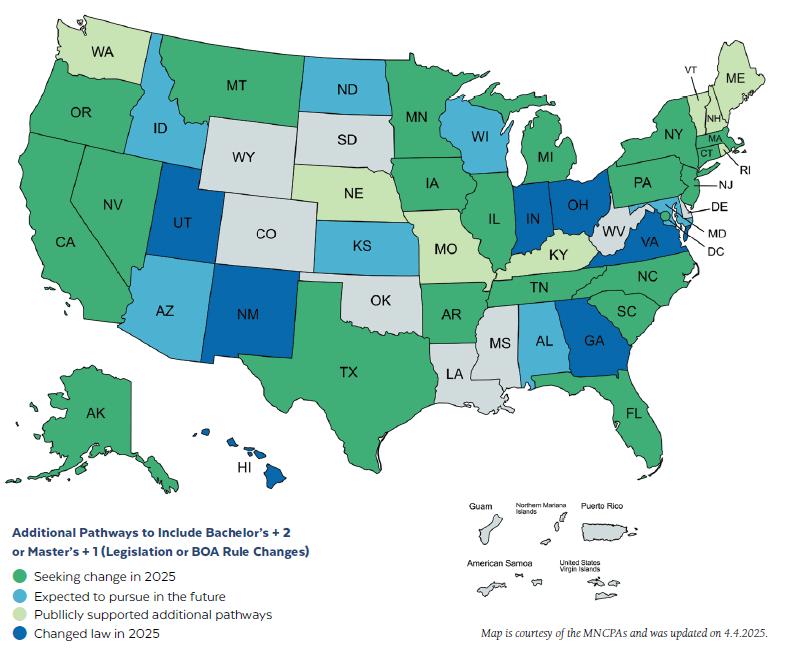

State-Level Adoption of Alternative Pathways

As of March 2025, several states have already adopted or are considering alternative pathways to CPA licensure. States such as Texas, Florida, Ohio and Illinois have introduced or are exploring legislation that would allow for more flexible licensure routes. These pathways often reduce or eliminate the traditional 150-credit-hour requirement in favor of more work experience. Other states, such as Nebraska, Missouri and Kentucky, have also expressed support for such changes, recognizing the need to adapt to the evolving demands of the profession.

Where Arizona and the ASCPA Stand

Arizona, while not yet moving forward with changes, is closely monitoring developments and plans to implement reforms in 2026.

“At the ASCPA we stand in agreement with the AICPA and NASBA and their effort to address the rising costs of education, meet the demands of the modern workforce and tackle the talent shortage in the accounting profession,” says President & CEO of the ASCPA, Oliver Yandle. “The ASCPA is actively working with the Arizona State Board of Accountancy and collaborating with legislators to introduce mobility and alternative licensure pathway legislation in 2026. This will enable us to ensure that Arizona’s legislation is in maximum alignment with other states and the UAA and meets the needs of the profession and Arizona’s business community.”

As we move forward with advocacy efforts, we will continue to keep members apprised of how we are being a voice for current and future CPAs in Arizona with the Legislature.